For years, discussions around blockchain in finance were dominated by speculative markets and the volatility of tokens. But a seismic shift is underway, not triggered by a meme coin, but by one of the most respected names in digital payments: Stripe.

The announcement of Tempo, a new high-throughput blockchain for stablecoin payments built by Stripe and Paradigm, is not just another industry experiment.

It’s a declaration that the future of global payments is being built on blockchain infrastructure.

This isn’t about hype.

This is about plumbing the underlying rails that enable the next era of financial services.

And for enterprises and fintech innovators, it’s a moment that demands attention.

The Stripe Signal: Why Tempo Changes the Game

So, what exactly is Tempo?

Early reports describe it as a new Layer 1 blockchain built specifically for real-world, high-volume financial activity:

- Global remittances

- Instant B2B payouts

- Scalable microtransactions

- Stablecoin-native settlement flows

With massive throughput and sub-second finality, Tempo is engineered to operate at the speed of traditional payment networks but with the transparency, programmability, and global accessibility of decentralized systems.

Stripe’s involvement is the key.

A company that processes hundreds of billions of dollars annually doesn’t build a blockchain “for fun.”

This is a strategic move that validates a thesis we at BlocLabs have championed for years:

The true blockchain revolution lies in secure, scalable infrastructure, not speculative tokens.

Stablecoins, digital assets pegged to fiat currencies, are emerging as the killer app of enterprise finance. They offer crypto-speed without crypto-volatility.

Tempo is a purpose-built superhighway for stablecoins, designed for business, not speculation.

Beyond “Accepting Crypto”: The Shift to Blockchain-Native Finance

Tempo signals the end of a transitional era, where “crypto strategy” meant nothing more than adding Bitcoin as a checkout option.

That was a marketing decision, not a financial infrastructure strategy.

The new paradigm is different:

It’s not about accepting crypto.

It’s about running your financial operations on blockchain rails.

Tempo and similar networks unlock capabilities that traditional systems simply cannot match:

• Faster Global Settlement

Why wait 3–5 days for an international wire when you can settle for a fraction of a cent in seconds?

• Real-Time, Mass Payouts

Imagine a marketplace instantly paying tens of thousands of global sellers, no batching, no bank delays.

• True Programmability

Money that moves automatically based on business logic, smart contracts, and verifiable events.

This is the direction that Stripe is building toward.

This is the direction the entire industry is moving.

But seeing the future is one thing.

Integrating it is another.

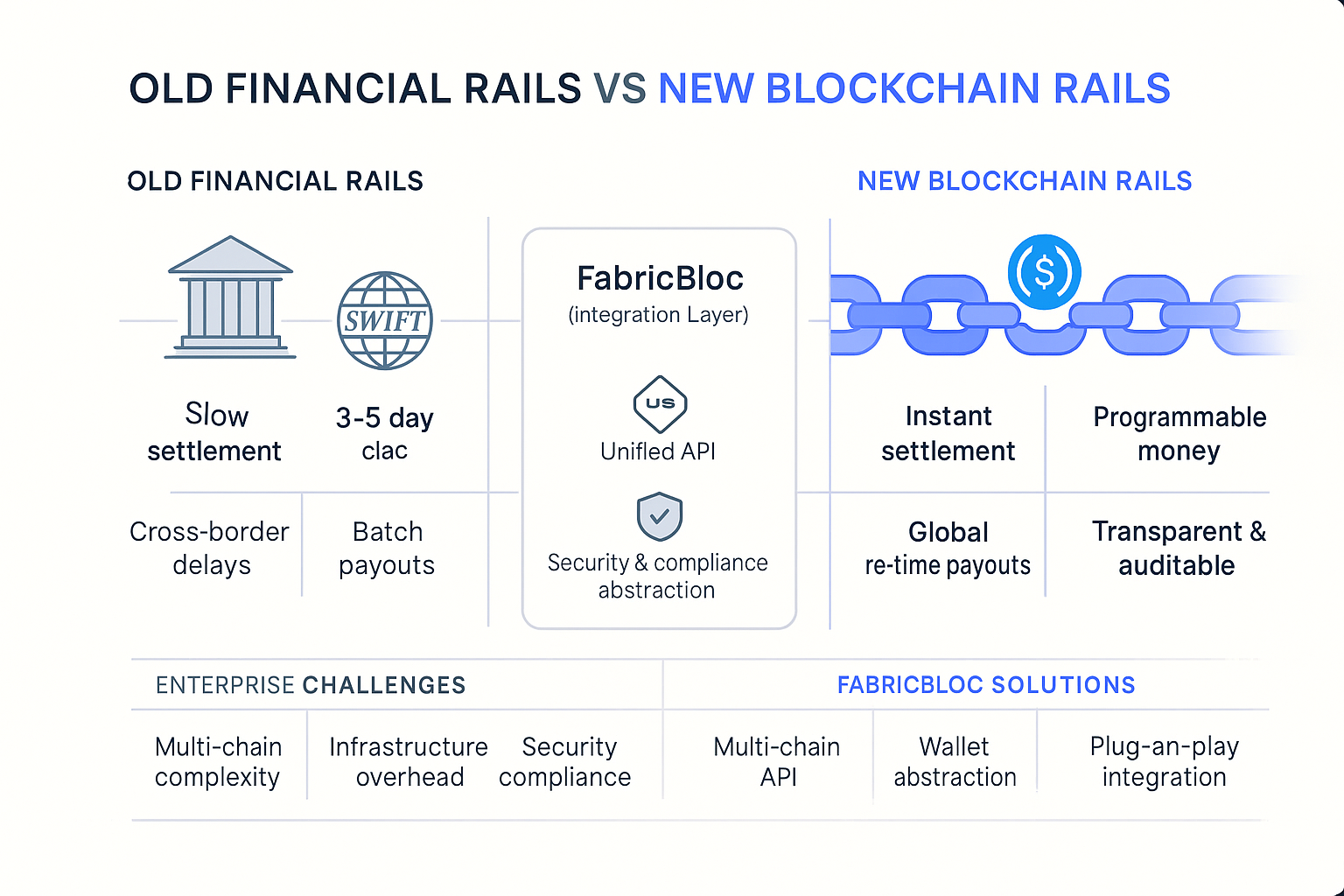

The Enterprise Challenge: Integrating Tomorrow’s Rails with Today’s Systems

For CTOs, CIOs, digital transformation leaders, and fintech founders, the opportunity is huge, but the implementation reality is complex.

Integrating a next-gen blockchain like Tempo requires navigating:

1. Multi-Chain Complexity

Do you bet on Tempo?

What about Solana, Ethereum L2s, or private chains?

A single-chain strategy is a dangerous bet in a fast-moving ecosystem.

2. Infrastructure Overhead

Running nodes, managing private keys, securing wallets, this isn’t trivial.

It’s an entirely new operational burden.

3. Security & Compliance

Every blockchain transaction must be:

- Secure

- Auditable

- Regulated

- Monitored

Most enterprises can't afford to build this in-house.

4. Resource Drain

Your engineering team should be building your product, not reinventing blockchain plumbing.

Enterprises need a way to adopt blockchain-native payment networks without turning their organization into a protocol engineering team.

They need a bridge between the old world and the new.

FabricBloc: Your Plug-and-Play Gateway to the Future of Payments

This is exactly why we built FabricBloc.

FabricBloc is an enterprise-grade blockchain infrastructure platform that abstracts away the complexity of Web3, enabling organizations to integrate modern payment rails with the reliability and simplicity they expect from traditional systems.

FabricBloc is the plug-and-play integration layer that helps enterprises move from hype to production.

Here’s how we enable companies to leverage networks like Tempo without rebuilding their entire infrastructure:

• Multi-Chain APIs

With FabricBloc, you never have to choose a “winner.”

Our unified API allows you to connect to multiple leading blockchains, including payment-optimized networks like Tempo.

As the ecosystem evolves, you automatically evolve with it without rewriting code.

• Wallet & Transaction Abstraction

FabricBloc handles the cryptographic heavy lifting:

- Secure institutional wallets

- Key management

- Transaction signing

- Token management

Your developers interact via simple, familiar APIs.

• Security & Compliance Built-In

FabricBloc’s infrastructure includes:

- Auditable transaction flows

- KYC/AML modules

- Identity verification

- Automated monitoring

- Policy-based controls

We make enterprise compliance frictionless.

• Future-Proof Architecture

FabricBloc ensures you’re not locked into one blockchain.

You’re building for the entire future of payments.

A Vision for Seamless Integration

Imagine this:

Scenario 1: Global Logistics

A shipping logistics company settles payments instantly with partners across Asia, Europe, and Africa using USDC routed across the fastest chain at that moment.

All powered through a single FabricBloc API call.

Scenario 2: Next-Gen Remittance

A fintech builds a remittance app that dynamically selects the cheapest, fastest blockchain for every transfer in real time without ever touching blockchain infrastructure directly.

Scenario 3: Marketplace of the Future

A global marketplace pays thousands of sellers instantly via smart-contract–driven payouts, eliminating delays and dramatically reducing treasury overhead.

This is the world Tempo points toward.

This is the world FabricBloc enables.

The technology is no longer a barrier.

Execution is.

The Future Is Multi-Chain, Instant, and Infrastructure-Led

Stripe’s launch of Tempo is not just industry news; it’s a roadmap.

Payments are being rewritten on decentralized rails.

The question is no longer if the shift will happen, but who will be ready for it.

The next era of financial innovation belongs to the companies that embrace secure, scalable infrastructure.

Don’t just watch it happen, build with it.

Learn how FabricBloc prepares your enterprise for the future of payments.

Request a pre-launch demo today and start building beyond the tokens.