Building the Future of Banking: What Blockchain-Based Banks Mean for the Next Era of Web3 Infrastructure

The tectonic plates of global finance are shifting. For years, the discussion around blockchain in banking has oscillated between disruptive potential and entrenched institutional inertia. But theory is now converting into practice.

The launch of N3XT, a new blockchain-native bank founded by former executives of Signature Bank, home of the well-known Signet payment network, is more than an industry headline. It is a definitive signal that the future of financial infrastructure is not upcoming; it is already under construction.

This moment represents a clear inflection point. It pushes the industry beyond the idea of merely “servicing the digital asset economy” and toward re-architecting the foundational rails of finance itself.

To understand the significance, we must examine both the void N3XT aims to fill and the technological leap it embodies.

From Signet to N3XT: A New Operating System for Banking

When Signature Bank and Silvergate closed, the digital asset ecosystem lost its critical plumbing. Their real-time payment networks Signet and SEN functioned as the circulatory system for exchanges, market-makers, fintechs, and institutions operating in 24/7 global crypto markets.

These networks solved a fundamental mismatch:

Traditional finance operates in business-hour batches; digital markets operate continuously.

The creation of N3XT led by the architects behind Signet is a direct answer to that infrastructural vacuum. But N3XT is not simply recreating an old network. It is introducing an entirely new banking model: a blockchain-based financial institution whose core operations leverage distributed ledger technology.

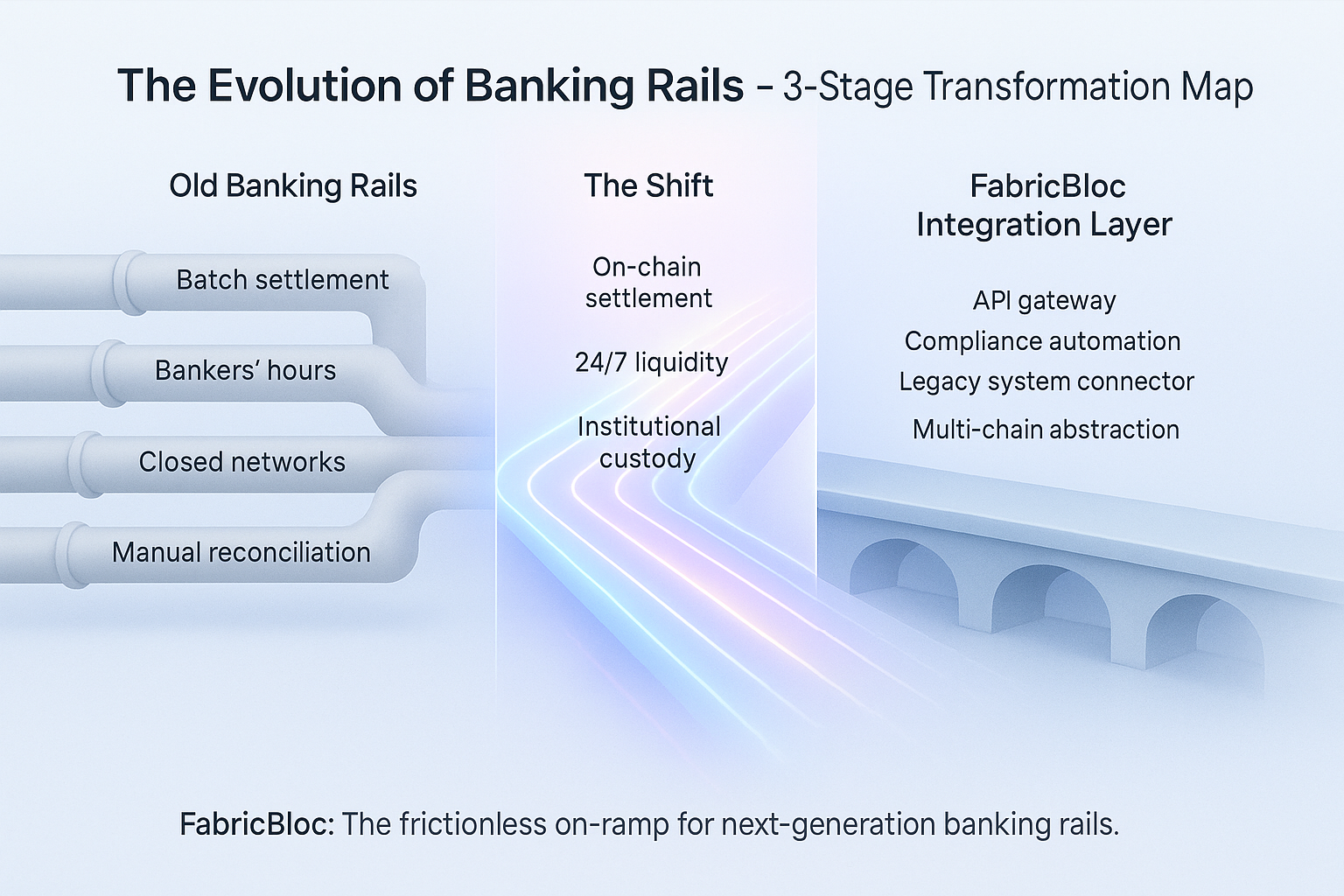

This shift places three infrastructure pillars at the center of the next-generation banking stack:

- On-chain settlement

- 24/7 liquidity rails

- Institutional-grade custody

Pillar 1: On-Chain Settlement: Eliminating “Bankers’ Hours”

Financial settlement has historically relied on batch processing, delayed finality, and T+1/T+2 clearing cycles mechanisms that introduce friction, counterparty risk, and opacity.

On-chain settlement changes the paradigm:

- Instant finality: Transactions settle within seconds, unlocking working capital and improving treasury operations.

- Shared truth: Every participant views the same immutable ledger, drastically reducing reconciliation overhead.

- Programmability: Payments become workflows. Smart contracts automate escrow, payouts, distribution schedules, and financing triggers.

This is not an incremental improvement. It is a structural transformation.

Pillar 2: 24/7 Liquidity: Finance That Never Sleeps

A global economy cannot depend on systems that shut down at 5 p.m. or pause on weekends.

Blockchain-native banks like N3XT are being designed to support:

- Always-on capital movement

- Tokenized deposits enabling peer-to-peer transfers

- Real-time treasury operations across borders

For businesses operating internationally, this eliminates inefficiencies that previously hindered settlement, invoicing, and cash flow cycles.

Pillar 3: Institutional Custody: Securing the New Industrial Stack

As major financial assets transition onto blockchain-based rails, regulated, resilient custody becomes essential.

The next wave of digital-native banks is building custody with:

- Multi-party computation (MPC)

- Hardware security modules (HSMs)

- Regulatory-grade access controls

- Insurance-backed asset protection

Large enterprises, asset managers, and banks require this before committing strategic capital to digitized financial products.

The Infrastructure Gap: Who Will Power the Transition?

The possibilities are clear, but integrating with this next-generation financial architecture is not.

Enterprises, fintechs, and even incumbent banks face significant challenges:

- Navigating regulatory and compliance frameworks

- Implementing secure blockchain environments

- Ensuring interoperability with legacy systems

- Scaling without sacrificing performance

This is the infrastructure gap slowing down adoption.

And this is where platform partners become essential.

Building with BlocLabs & FabricBloc: Laying the Rails for Modern Finance

At BlocLabs, our mission is to democratize access to next-generation financial infrastructure. We allow enterprises to build, integrate, and scale blockchain capabilities without becoming blockchain engineers themselves.

Enterprise Blockchain Infrastructure with BlocLabs

We partner with financial institutions, corporates, and fintechs to deliver:

- Private payment networks

- Tokenized asset platforms

- Cross-border settlement systems

- Compliance-first blockchain architectures

Every deployment is built with security, regulatory alignment, and enterprise scalability at its core.

FabricBloc: Your API-First Gateway to Web3 Rails

FabricBloc is our universal integration layer connecting traditional systems to blockchain networks without the cost and complexity of legacy modernization programs.

With FabricBloc, organizations can:

- Connect existing treasury, payment, and core banking systems directly to blockchain rails

- Launch new digital products, 24/7 payments, tokenized assets, on-chain settlements within weeks

- Future-proof their architecture by abstracting away blockchain complexity

Instead of multi-year transformation programs, FabricBloc provides a faster, safer path to modern financial infrastructure.

The Convergence Has Arrived

The launch of N3XT is a watershed moment. It validates the demand for:

- Real-time settlement

- Transparent financial infrastructure

- Always-on liquidity

- Institutional custody

- Enterprise-grade blockchain integration

The debate over blockchain’s utility is over. The era of building with it has begun.

The leaders who move now will define the standards for the next century of financial infrastructure. The question is no longer whether to participate but how.

And the journey starts with the right infrastructure partner.